SMART Investing made Simple: How To Build Wealth With A Plan

Every Investor, whether seasoned or just starting,

faces a common challenge- how to set and achieve meaningful financial goals.

The truth is, investing without a clear strategy is like navigating without a

map. This is where SMART Investing comes into play. By focusing on a method

that is Specific and Systematic, Measurable, Attainable, Relevant and Time Bound,

you can align your investments with your long-term objectives, whether it’s buying

a home, securing retirement or funding your child’s education.

Let’s dive into each component, starting

with the first step

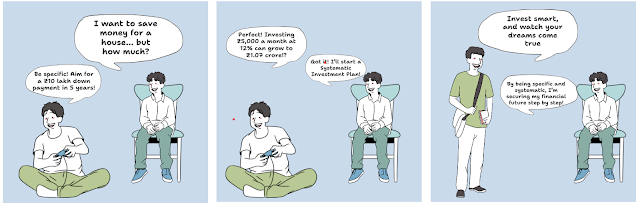

1) Specific and Systematic Investing:

Specific and Systematic Goals works best when it's specific and

systematic. Being "specific" means setting clear goals. For example,

rather than just saying, "I want to save money," you could say,

"I want to save ₹10 lakhs for a home down payment in 5 years." This

clarity helps you stay focused.

"Systematic" refers to

consistent, disciplined investing. For instance, a Systematic Investment Plan

(SIP) in mutual funds allows you to invest a fixed amount regularly, ensuring

steady growth through compounding. Over time, this method can help you achieve

your specific financial goals without large lump-sum investments.

In real life, if Jane, a 30-year-old,

starts investing ₹5,000 monthly via SIP for 26 years at a 12% annual return,

she could potentially grow her wealth to ₹1.07 crore. By being both specific

and systematic, Jane secures her financial future step by step.

This approach helps remove guesswork and

increases the likelihood of achieving long-term financial goals.

Key Takeaways in SIP Investing

1. How

to Invest in SIP

Choose

a mutual fund scheme and set up a Systematic Investment Plan (SIP).

Invest

a fixed amount at regular intervals (monthly/quarterly).

2. Documents

Required

PAN

card

Proof

of identity (Aadhaar, Passport, etc.)

Proof

of address

Bank

details (for auto-debit)

3. Rupee

Cost Averaging

A

strategy where SIP investments average out market highs and lows over time,

reducing the risk of timing the market.

4. Power

of Compounding

SIPs

benefit from compounding, where your returns generate more returns over the

long term.

5. Flexibility

Modify

or pause your SIP anytime based on your financial goals.

6. Ideal

for Long-Term Goals

Best

suited for achieving financial goals like retirement, buying a house, or

children's education.

2) Measurable

The "Measurable" aspect in SMART

investing helps track progress toward financial goals. Here's how you can apply

it practically.

1. Set

Clear Targets

Define your financial goals—retirement, buying a home, or saving for your

child’s education. Use calculators like ROI or financial goal calculators to

measure how much you need to invest regularly to meet these goals.

2. Track

Investment Performance

Tools like CAGR and ROI allow you to measure the return on your investments

over time. For instance, if you invest ₹33,000 and it grows to ₹80,000 in three

years, your CAGR is 34.34%.

3. Use

Financial Goal Calculators

Planning to buy a house in 8 years? Use a financial goal calculator to

determine the future cost of your goal and how much you need to save monthly.

For example, saving ₹12,835 monthly at an 8% return will accumulate ₹17,18,186

over 8 years.

4. Monitor

Growth Regularly Regularly review your investments. Measure progress to make adjustments if

needed, ensuring you’re on track to meet your financial targets.

3) Attainable

An attainable goal must be realistic, based on your current financial situation, and achievable within a specific timeframe. To set an attainable goal, follow these steps:

1) Assess Your Income & Expenses: Understand your current income, savings, and debts.

2) Use Financial Tools: Utilize calculators like retirement, tax-saving, or goal-planning tools to set measurable targets.

3) Plan Regular Investments: Choose a schedule (monthly, quarterly) that aligns with your cash flow.

4) Balance Priorities: Focus on both short-term and long-term goals, ensuring they are achievable without overburdening your finances.

4) Relevant

Investing strategies should be tailored to life stages, risk appetite, return preference, investment constrains, time constrains etc. For example, someone in their 30s might prioritize wealth accumulation for long-term goals like buying a house or retirement planning. At this stage, they can afford to take on higher risks and invest more in equities, which offer higher returns over time.

In contrast, someone in their 50s is likely more focused on preserving wealth for retirement. With fewer working years left, they might shift towards lower-risk investments like bonds or balanced mutual funds to ensure capital protection.

Real-Life Example:

30s: Shruti, a 32-year-old, invests heavily in equity mutual funds through a SIP to grow her savings for a home in 10 years.

50s: Ramesh, 55, is nearing retirement and reallocates his portfolio to bonds, prioritizing stability over growth to secure his retirement corpus.

This highlights the relevance of adjusting investment strategies to match life goals at different stages.

5) Time Bound

Time bound Investing means aligning Investment Horizon with Personal Financial Goals.

An Investment Horizon is the period you plan to hold an investment, and it directly affects how you manage risk and returns. Aligning your investment choices with your financial goals and time horizon is key to successful investing.

1) Short-Term Goals (1-3 years): For goals like a vacation or emergency fund, focus on safer options such as liquid funds or bank deposits. These provide stability with minimal risk.

2) Medium-Term Goals (3-7 years): Goals like buying a car or saving for education can benefit from short-term debt funds or balanced equity funds, which offer a moderate mix of risk and growth potential.

3) Long-Term Goals (7+ years): For long-term goals like retirement or buying a house, equity investments are ideal, providing higher returns over time, though with more volatility.

By matching your investment horizon with specific financial goals, you can effectively balance risk and ensure your money is working toward.

Conclusion: Why SMART Investing is Worth It

SMART Investing—being Systematic and Specific, Measurable, Attainable, Relevant, and Time-bound—empowers you to achieve your financial goals in a structured, disciplined manner. By aligning your investments with clear objectives and time horizons, you enhance the chances of reaching your desired outcomes, whether they are short-term needs or long-term wealth-building.

However, it's essential to recognize the risks involved, such as market volatility, economic shifts, and personal financial setbacks. Balancing risk with proper asset allocation and regular review ensures your goals remain achievable, making SMART investing a truly worthwhile approach.

Post a Comment